CATAWBA REGION

INDUSTRY INVENTORY AND ANALYSIS OF LOCAL CLUSTERS

Labor Force (10/2022)

219,290

The Catawba Region

Unemployment Rate (10/2022)

3.67%

The Catawba Region

Employment Number (Aug 2021)

211,234

The Catawba Region

Employment in Local Clusters

66%

The Catawba Region

CATAWBA SECTORS

Industrial Inventory and Cluster Analysis

At the various geographies of analysis presented in the Economic Development Strategy, industries are clustered by NAICS codes. It is important to understand that NAICS codes are self-reported by individual industries to the U.S. Census Bureau. At times, this may mean that the code by which an industry identifies itself may not be intuitively associated with the employment center.

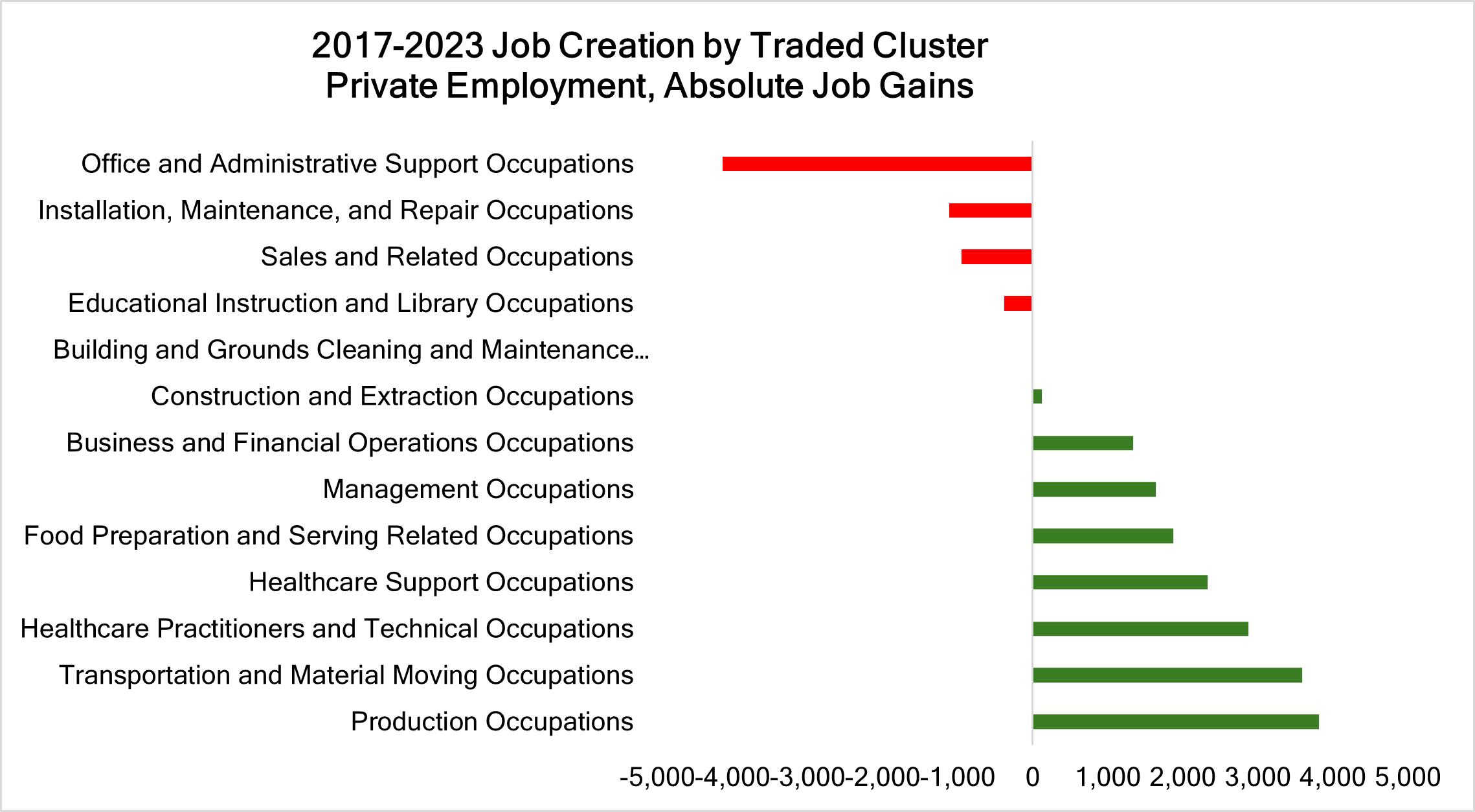

Additionally, clusters are broken out into two major reporting categories, traded and local:

- Local Clusters – these are clusters of industries that typically provide goods and services that are created and either consumed or delivered within the region of analysis.

- Traded Clusters – these are clusters of industries that typically export goods and services created within the region to be consumed or delivered outside the region.

Please note that while we will look at both Local Clusters and Traded Clusters in the Catawba Region section of the strategy, to present and analyze the two commuter sheds, we will only focus on Traded Clusters. Traded Cluster industries tend to be larger in scale and typically provide broader income opportunities to which workers are willing to commute.

The Advanced Manufacturing, Logistics and Distribution, and Healthcare clusters were existing targeted clusters. The Healthcare Cluster has been expanded to include life sciences, an interrelated industry with high-paying jobs. Information Technology was added as a target cluster because QTS Data Centers is investing $1 billion to construct a data center in York County, SC. This data center will be the first for South Carolina. Local educational institutions have also shown a desire to develop operation centers to enhance educational, research, and workforce training opportunities for the information technology industry.

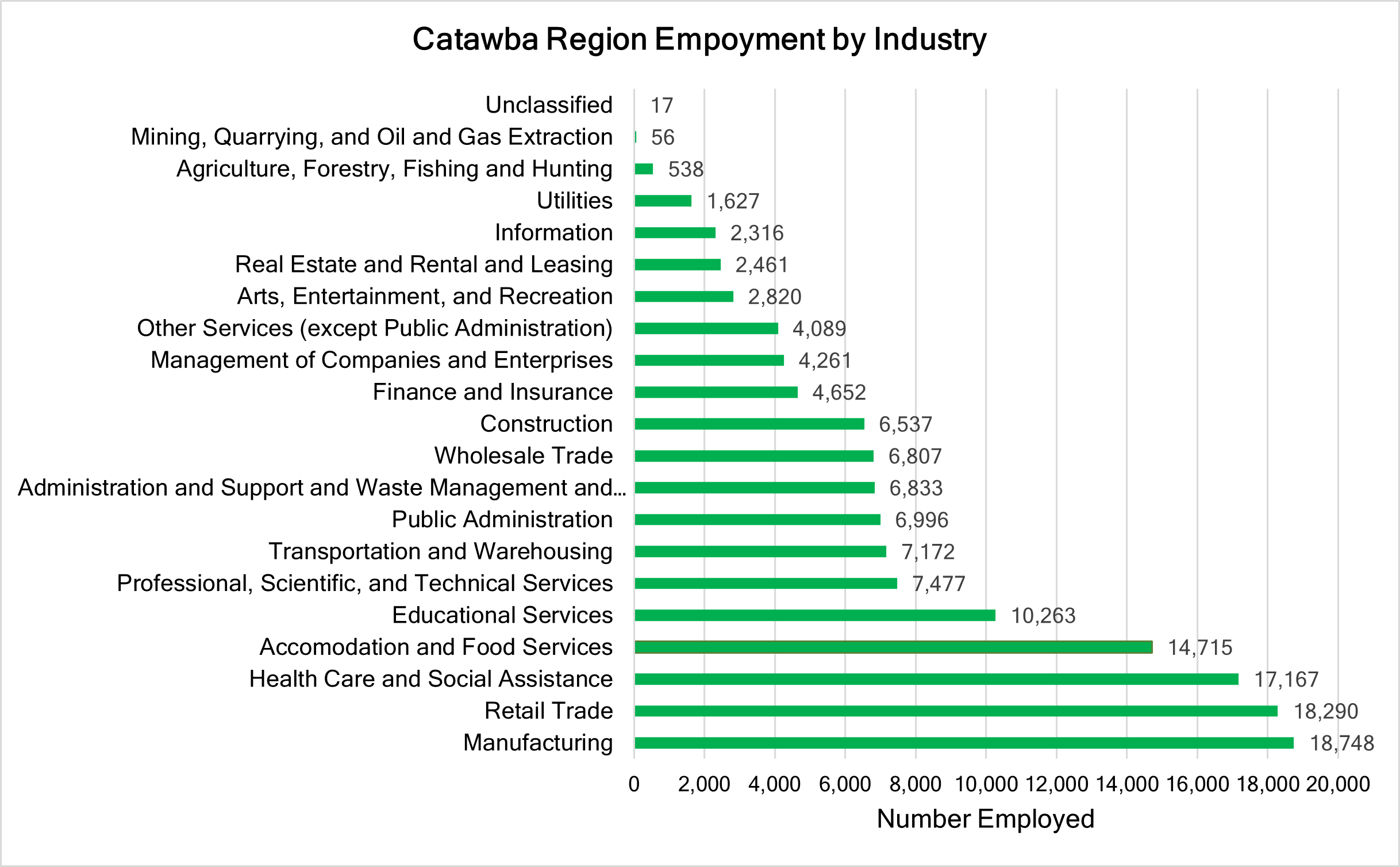

Manufacturing is the leading industry for Chester and Union Counties, Retail Trade is the leading industry for York County, and Health Care and Social Assistance is for Lancaster County. York and Lancaster Counties’ leading industries are local traded industries, while Chester and Union Counties’ leading industry is a traded industry. Manufacturing is the fourth-ranked industry by employment in York County and the third-ranked industry in Lancaster County.

INDUSTRY ANALYSIS

Industry Inventory and Analysis – Catawba District

The U.S. Bureau of Labor Statistics provides quarterly data with Location Quotients for industries by county. Location Quotients compare local sector data to the national sector data. Location quotient analysis helps identify industry clusters. A cluster is identified if it has a relatively large share of employment compared to the nation. Location Quotients with a value greater than one (1) compared to the national data indicate that the industry is proportionally more concentrated than the nation, is an export activity, and is an important link to the outside economy.

The location quotients were analyzed for each county within the Catawba COG District to identify industry clusters for each county. Industries that provide 2024 employment numbers above 2,000 are shown in green bold font. The following industry clusters were identified per county:

York County’s Service-providing and Leisure/hospitality industry clusters have experienced significant growth. The primary driving forces behind the growth in both clusters are increased population and tourism within the Rock Hill / Fort Mill area of York County and the Indian Land area of Lancaster County. All four counties have goods-producing industries, which are traded clusters in the region. Manufacturing is a traded cluster in all four counties, while Professional and Business Services is a traded cluster for Lancaster County.

CHANGE IN EMPLOYMENT IN TOP 5 INDUSTRIES BY COUNTY

Chester County

Chester County industries have recovered from the COVID-19 downturn and are now growing. The Chemical Industry saw the most growth in Chester County, according to the National Economic Resilience Data Explorer (NERDE) chart for Change in Employment across the Top 5 industries.

Source: National Economic Resilience Data Explorer

Lancaster County

Most of Lancaster’s industries have recovered and grown since the COVID-19 pandemic downturn. Credit intermediation and related activities peaked in 2021 and then declined in 2023. This could be attributed to the Federal Reserve rate increases to combat inflation and related job losses in the financial industry.

Source: National Economic Resilience Data Explorer

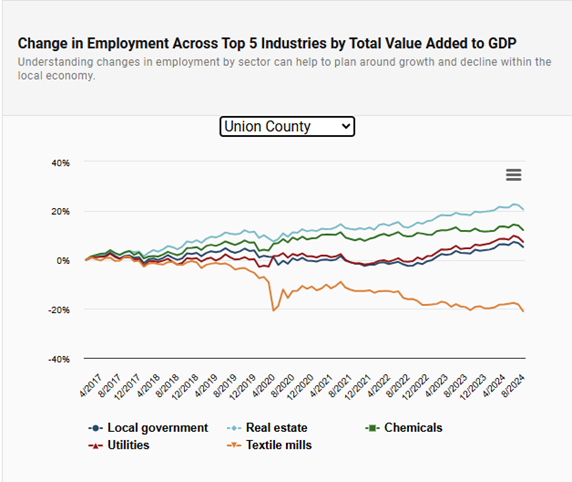

Union County

Union County’s top five industries have mostly recovered, except for the Textile Mills industry. The textile mills industry declined before the COVID-19 pandemic and continued to decline post-COVID-19 pandemic. Unfortunately, the industry has seen a 20% decline in employment. To make matters worse, in 2020, the Cone Mills Carlisle Plant closed. The Cone Mills Carlisle Plant lost over 1,000 jobs over 20 years beginning in 1999, with the final Warn notice indicating that 120 jobs were lost in 2020. The decline of the plant’s employment has reduced the population of the Town of Carlisle, created a vacant Carlisle downtown, and reduced the number of jobs in the region, impacting both Union and Chester County citizens.

York County

York County saw a minor slowdown in its top five industries due to the COVID-19 pandemic; however, four out of the five industries quickly recovered and grew. Like Lancaster County, York County saw a decline in the credit intermediation and related activities industry starting in 2023. This could be attributed to the Federal Reserve rate increases to combat inflation.